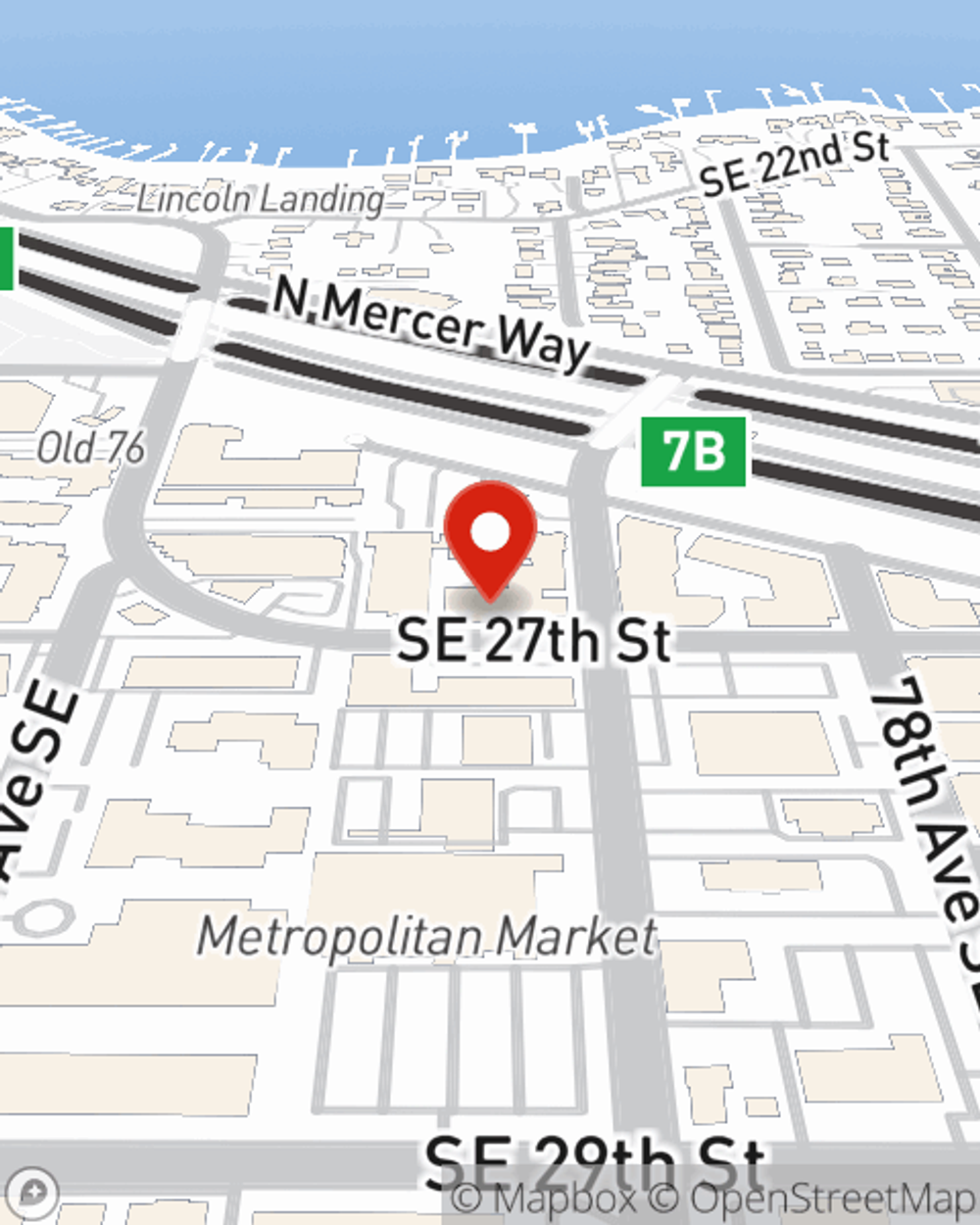

Business Insurance in and around Mercer Island

Looking for coverage for your business? Look no further than State Farm agent Tim Cashman!

Almost 100 years of helping small businesses

- Mercer Island

- Seattle

- Bellevue

- King County

- Pierce County

- Snohomish

- Kitsap

- mason

- Thurston

- Skagit

- multnomah

Help Protect Your Business With State Farm.

Operating your small business takes time, commitment, and great insurance. That's why State Farm offers coverage options like worker's compensation for your employees, a surety or fidelity bond, business continuity plans, and more!

Looking for coverage for your business? Look no further than State Farm agent Tim Cashman!

Almost 100 years of helping small businesses

Strictly Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a beauty salon, a donut shop or a pet groomer. Agent Tim Cashman is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call Tim Cashman today, and let's get down to business.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Tim Cashman

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.